Our Features In Detail

Explore how MoneyTrackerPro empowers you with AI-powered insights, comprehensive analytics, and secure multi-bank integration—everything you need to take control of your financial future.

AI-Powered Financial Intelligence

Save time and gain deeper insights with smart AI that automatically categorizes transactions, detects spending patterns, and delivers personalized weekly financial reports—so you always know where your money goes.

Automatic transaction categorization with high accuracy

AI-generated weekly summaries highlighting key insights

Smart anomaly detection for unusual spending

Personalized recommendations based on your financial behavior

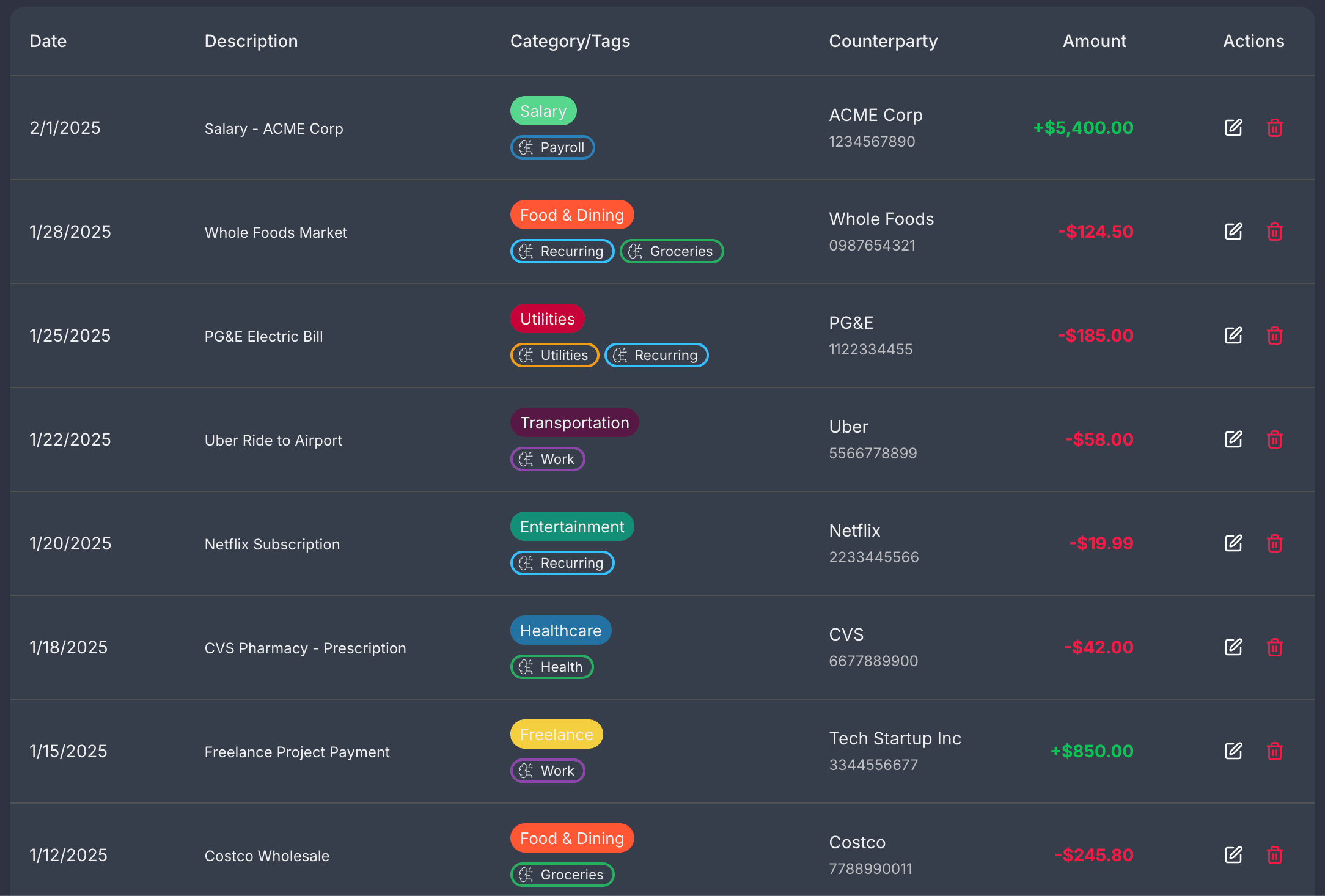

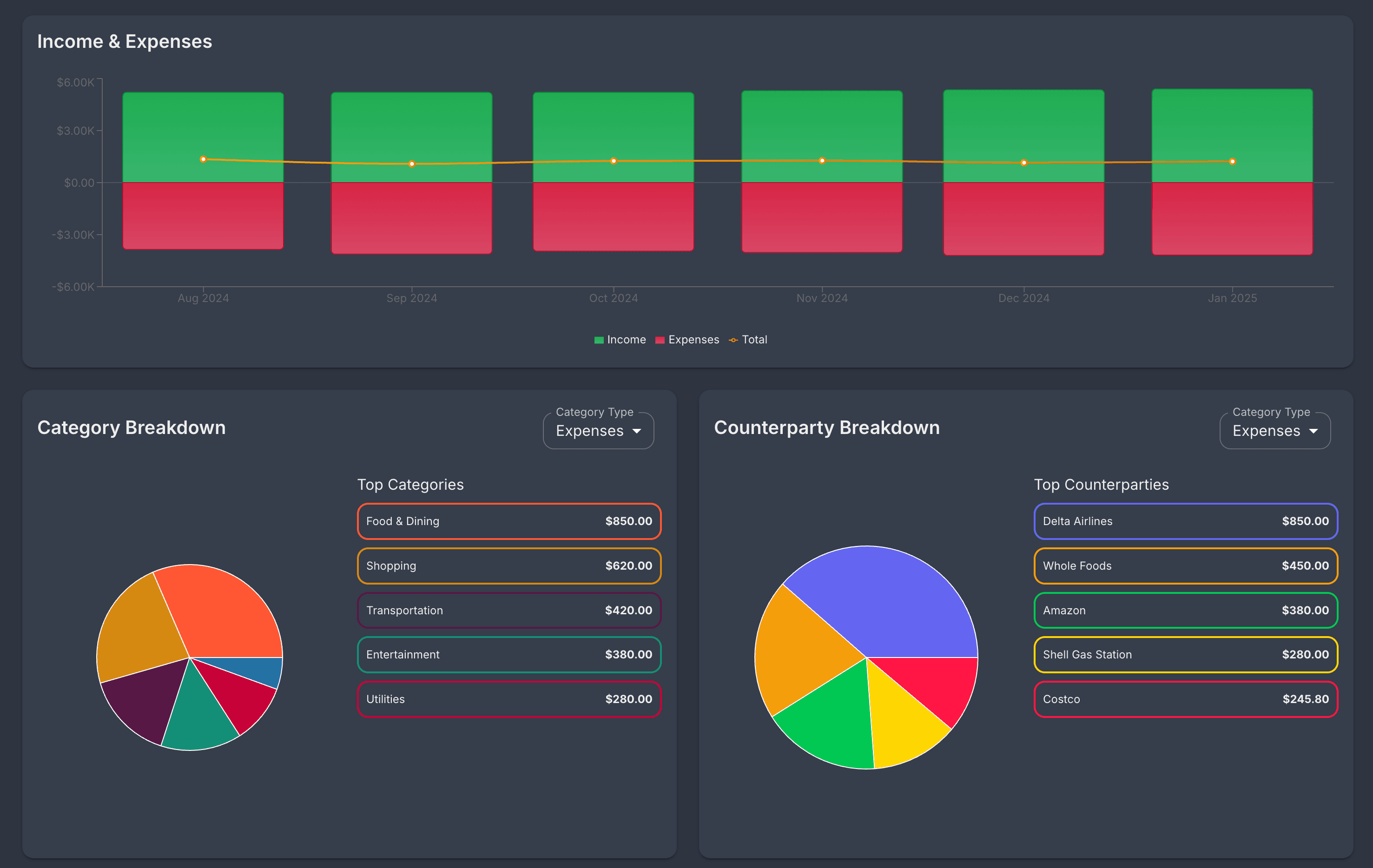

Advanced Analytics & Reports

Understand your financial patterns with powerful analytics. Break down spending by counterparty, analyze category trends, and generate custom reports to gain actionable insights.

Counterparty analysis showing income and expense patterns

Category breakdown charts with customizable time periods

Multi-currency support with automatic conversion

Export capabilities for tax preparation and record-keeping

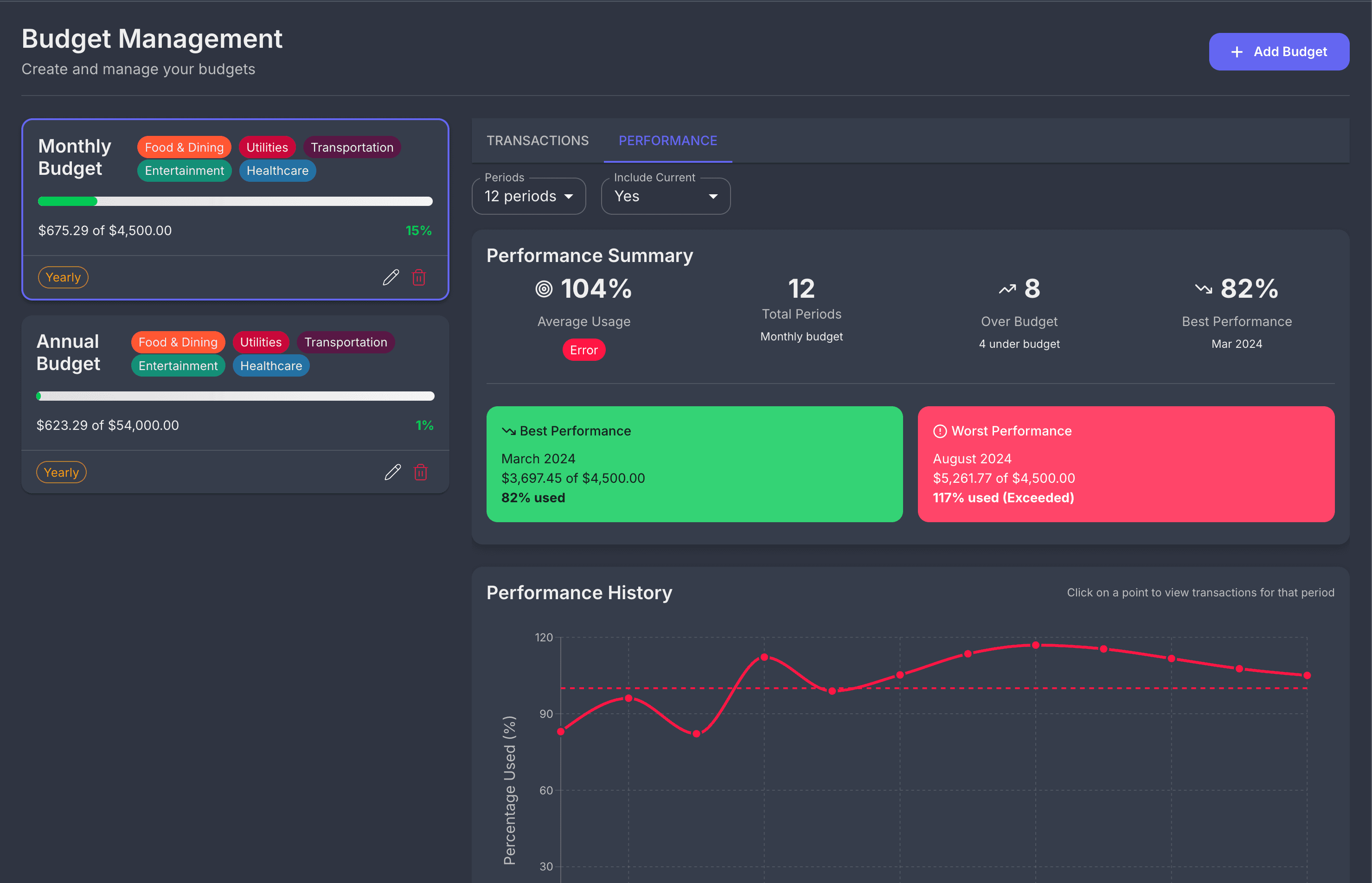

Smart Budgeting That Adapts to You

Take control of your spending with flexible budgets that track your progress in real-time. Get alerts when you're approaching limits and see detailed performance history to improve over time.

AI-suggested budget categories based on your spending habits

Real-time alerts and cumulative balance tracking

Flexible budget periods (weekly, monthly, custom)

Historical performance analysis to optimize your budgets

Seamless Multi-Bank Integration

Connect all your financial accounts in one place with secure banking integrations. Automatically import transactions from multiple banks and payment providers for a complete financial picture.

Connect multiple bank accounts and credit cards securely

Automatic transaction import via GoCardless banking API

Stripe payment tracking for business transactions

Consolidated dashboard showing all your accounts

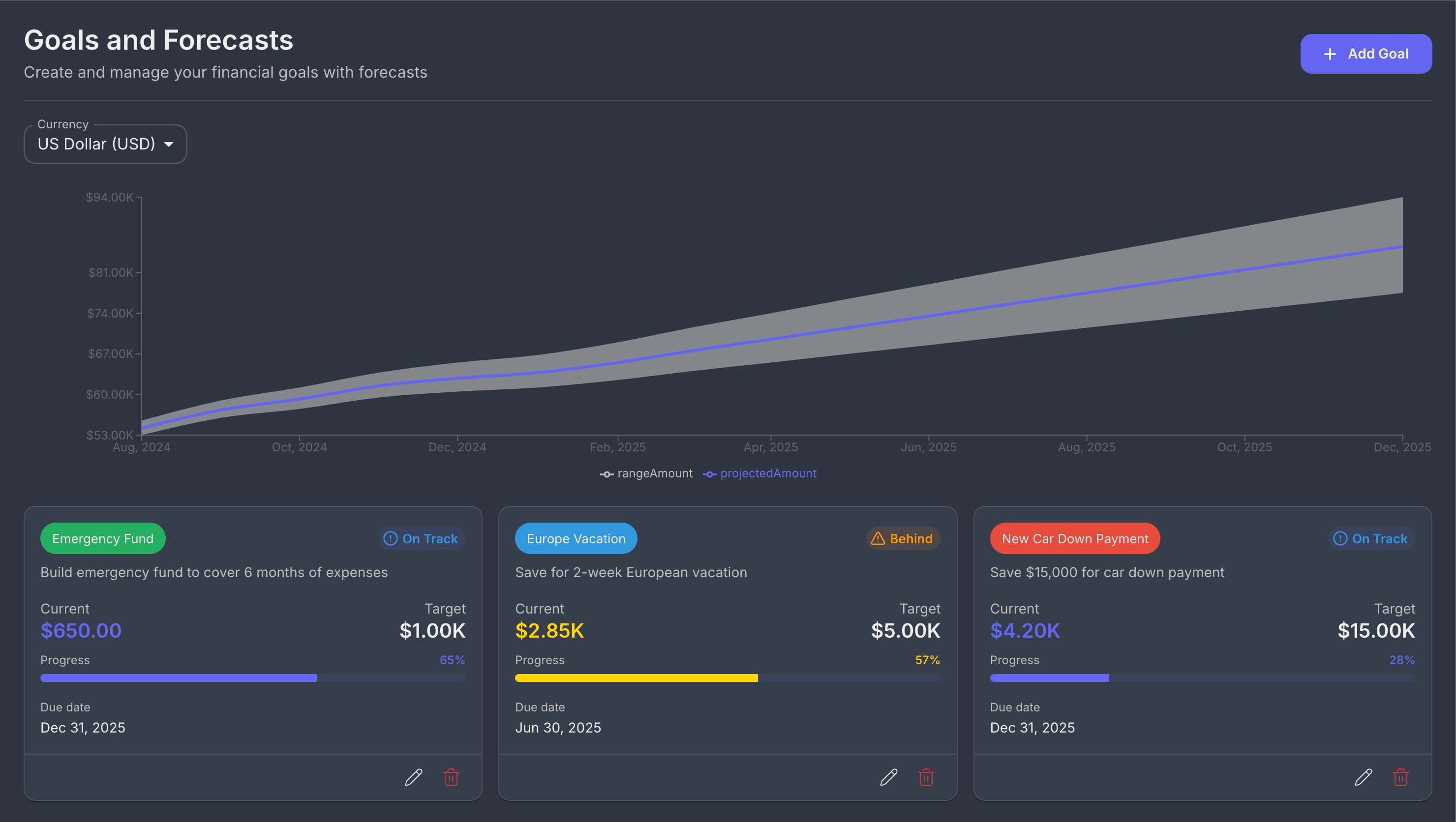

Achieve Your Financial Goals, Faster

Set meaningful financial goals and track your progress over time. Whether it's building an emergency fund, saving for a down payment, or planning retirement, visualize your journey and stay motivated.

Create point-in-time and incremental savings goals

Visual progress tracking with historical trend analysis

Flexible goal periods (monthly, quarterly, yearly)

Color-coded status indicators to stay on track

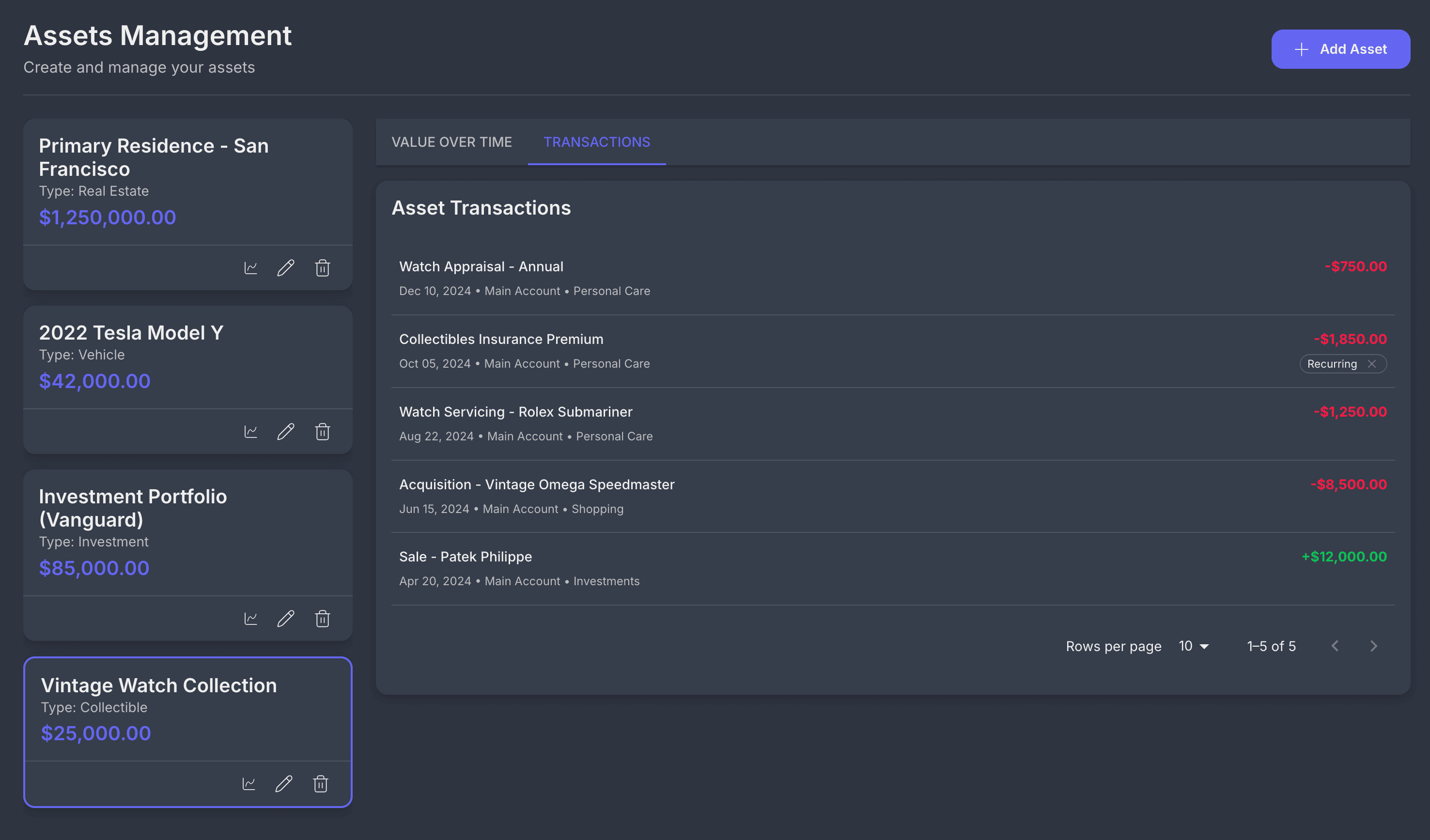

Comprehensive Asset Management

Track all your assets in one place—from real estate and investments to vehicles and collectibles. Monitor valuations, record transactions, and see your complete net worth picture.

Support for multiple asset types (property, investments, vehicles)

Transaction history for each asset with detailed categorization

Valuation tracking over time to monitor asset performance

Tag-based organization for easy portfolio segmentation